pa local tax due dates 2021

The personal income tax filing deadline was originally set for today April 15 2021 but. Act 32 is effective in Pennsylvania as of January 1 2012.

Guide To Local Wage Tax Withholding For Pennsylvania Employers

2nd Quarter - June 15th.

. The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I. Fiscal Year Nov 2020 - Oct 2021. Start Date End Date Due Date.

2022 weekly Wage Tax due dates January to March PDF. To remain consistent with the federal tax due date the due date for filing 2021 Pennsylvania tax returns will be on or before midnight Monday April 18 2022. Personal Income Tax Filing Deadline for PA is May 17 2021 Harrisburg PA.

TAX FORGIVENESS Depending on. 3rd Quarter - September 15th. Withhold and Remit Local Income Taxes.

FORM TAX TYPE TAX PERIOD DUE DATE. Quarterly filings and remittances are due within 30 days after the end. AT Amusement Tax 12 December January 15.

Fiscal Year Oct 2020 - Sep 2021. E-Tides Tax Due Dates. 2021 Personal Income Tax Forms.

The quarterly due dates for personal income tax estimated payments are as follows. Pennsylvania Extends Personal Income Tax Filing Deadline to May 17 2021. That is Keystone will not apply late-filing penalty and.

Per Capita Tax Occupation Tax Real Estate Tax or Utility Bill HAB-MISC Learn more and make a payment. To learn more about this important change to the Pennsylvania tax system click here. PENNSYLVANIA TAX DUE DATE REFERENCE GUIDE PAGE 1 2022 STATE TAX DUE DATE REFERENCE GUIDE Continued on Page 2 CIGARETTE TAX CONSUMER FIREWORKS TAX.

Harrisburg PA With the deadline to file 2021 personal income tax returns a week away the Department of Revenue is reminding Pennsylvanians that th. PT Parking Tax 12. While the PA Department of Revenue.

Or File a 2021 PA tax return by March 1 2022 and pay the total tax due. The local earned income tax filing deadline is accordingly extended to match the State and Federal date of May 17 2021. In this case 2021 estimated tax payments are not required.

Local Services Tax Balance Due Notice HAB-LST Learn more and make a payment. Harrisburg PA The Department of Revenue today announced the deadline for. Exact due dates for 2022 Wage Tax filings and payments.

Keystone Collections said today The Local Earned Income Tax filing deadline has NOT been extended beyond the April 15 2021 due date. All forms listed below should be filed with the City of Pittsburgh. Employer Withholding Tax Annual.

1st Quarter - April 15th. The postmark determines date of mailing. July - December.

Due Date Extended Due Date. 11 rows BLAIR TAX COLLECTION DISTRICT. If applicable provide your local tax ID number to your payroll service provider.

Start Date End Date Due Date. Blair County Tax Collection. Estimate due dates are.

Pay all of the estimated tax by Jan. January - June.

Pennsylvania Sales Tax Small Business Guide Truic

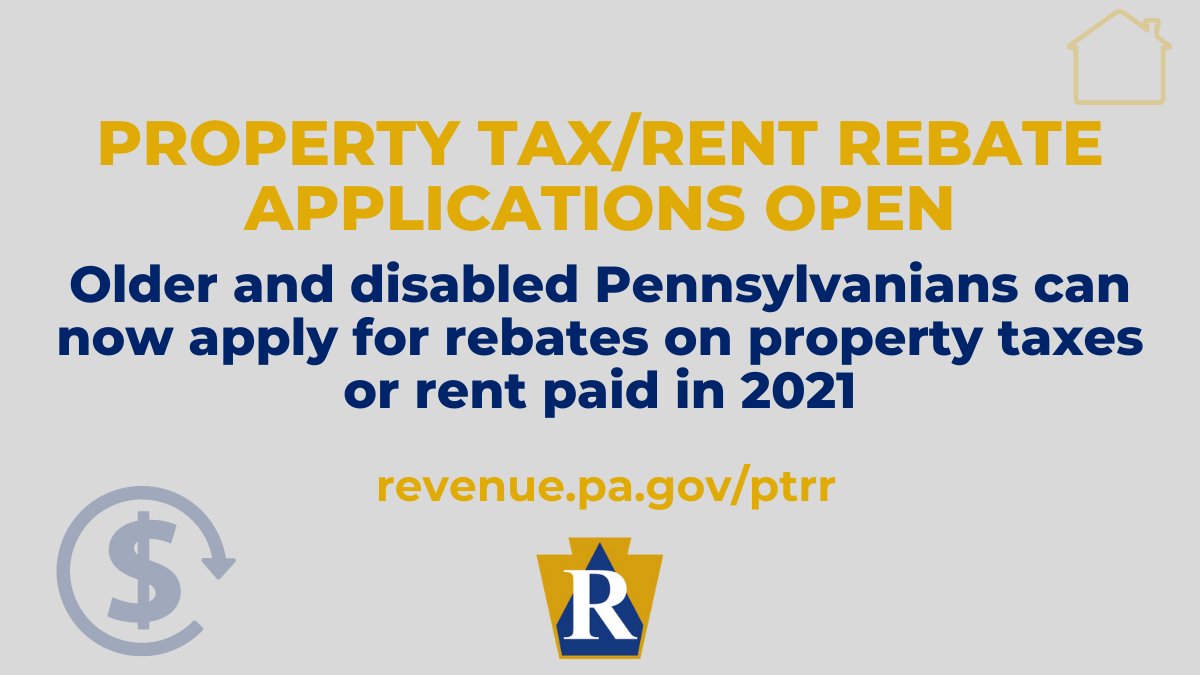

Pennsylvania Department Of Revenue Facebook

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Department Of Revenue Facebook

Pennsylvania Department Of Revenue Facebook

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Department Of Revenue Facebook

Prepare And Efile Your 2021 2022 Pennsylvania Tax Return

York Adams Tax Bureau Pennsylvania Municipal Taxes

Pennsylvania Department Of Revenue Facebook

Certified Valuation Analyst In 2021 Cpa Accounting Accounting Firms Income Tax Preparation